VA Loan Limits 2021: Maximum Amount by State

Table of Content

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers, and others with their full entitlements, can borrow as much as lenders are willing to approve. VA loan limits determine how much a Veteran with reduced entitlement can borrow before needing to factor in a down payment. VA loan limits vary by county and currently range from $726,200 to $1,089,300. VA loan benefits before or has repaid the previous VA loan fully has full entitlement and is not subject to any loan limits. VA does not limit how much you can borrow from your lender to finance a home.

For most people eligible for the VA loan program, loan limits are not an issue. Full entitlement gives you a lot of flexibility when searching for a home. However, impacted entitlement subjects you to conforming loan limits which, although higher in 2023, may make it more difficult to purchase the home of your dreams.

Va Loan Limit Example

In addition to this, the borrower must meet all underwriting criteria and originator overlays to qualify. The VA does not have a minimum credit score used for pre-qualifying for a mortgage loan, however, most Lenders require a minimum credit score of at least 620. On June 22, 2019, the VA loan program celebrated its 75th anniversary since the passing of the original Servicemen's Readjustment Act, also knowns as the G.I. During the celebration, the Department of Veterans Affairs announced the program had guaranteed 24 million VA home loans since its inception.

Some Certificates of Eligibility will show 1) total entitlement, and 2) available entitlement among other data.

VA Loan Bonus Entitlement

If you have reduced entitlement and want to know how much you have left, you’ll need to figure out how much of it you’re currently using. If you’re experiencing financial hardship due to the COVID-19 emergency, you can request a temporary delay in mortgage payments. Jimmy Vercellino, a Marine veteran, specializes in helping military veterans benefit from the VA Loan Program and buy the home of their dreams.

Interest rates are another important factor in your decision. Because VA loans are guaranteed by the VA, they often have slightly lower interest rates than conventional loans . VA loans are perhaps the best military benefit available to Veterans and military members. You can use this benefit to purchase your first home or even second.

Compare Top VA Lenders

A VA entitlement is a specific amount guaranteed by the government. The amount can either be $36,000 or 25% of the loan amount. Find out if you're eligible and how to apply for a VA home loan COE as the surviving spouse of a Veteran or the spouse of a Veteran who is missing in action or being held as a prisoner of war. Learn how VA-backed and VA direct home loans work—and find out which loan program might be right for you. If you still own the home, and you are renting it out – you might be able to purchase a new home using your partial entitlement, but there are several restrictions.

In this example, you can purchase a home with $0 down up to $407,200. Anything above that mark would require a down payment equal to 25 percent of the difference between that ceiling and the purchase price. In this example, you can purchase a home with $0 down up to $486,200. If the lender is not willing to offer you the amount you need, you can talk to other lenders to compare the quotes or choose a house that fits your budget. You may be able to get a COE if you meet at least one of these requirements.

These limits differ depending on case to case and your geographical location. According to an amendment made by the VA back in 2020, there are no loan limits for Veterans or other qualifying applicants with full entitlement. In short, if an applicant has full entitlement, they can borrow as much amount they qualify for. If you served for at least 90 days of active duty, you meet the minimum service requirement. For the VA, entitlement refers to how much money it will guarantee repayment to lenders if a borrower defaults. Often, the VA guaranty is 25 percent of the loan, which provides most of the country with a standard entitlement figure.

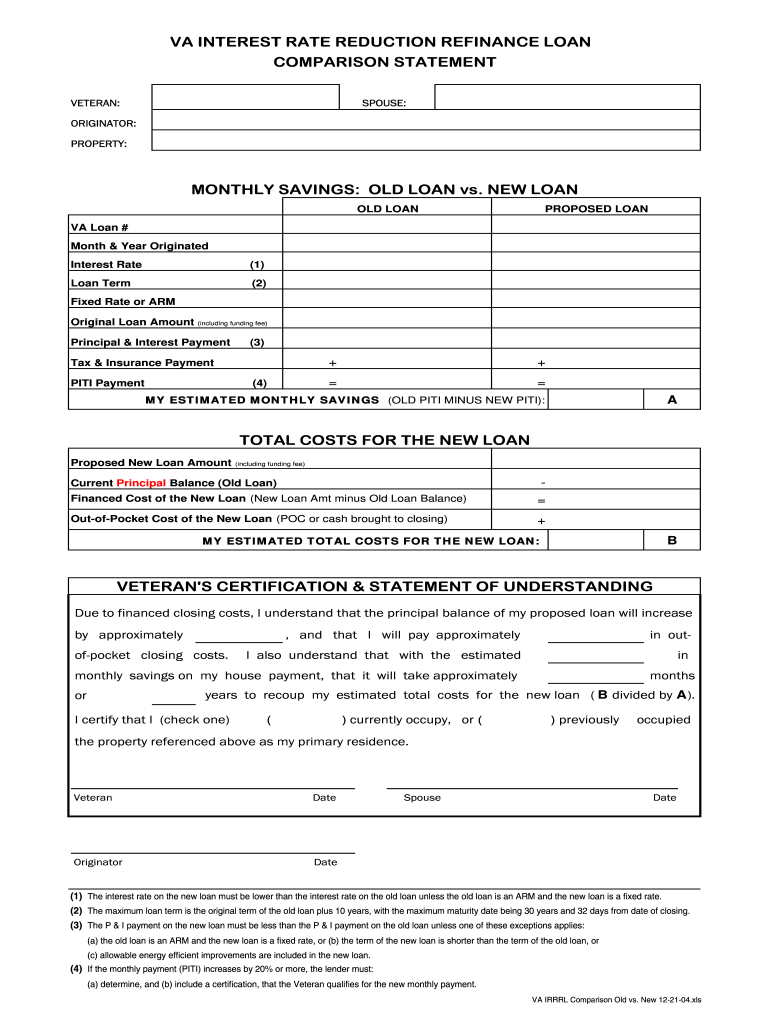

In a refinance where the loan is a VA loan refinancing to VA loan , the veteran may borrow up to 100.5% of the total loan amount. The additional .5% is the funding fee for a VA Interest Rate Reduction Refinance. A VA loan is a mortgage loan in the United States guaranteed by the United States Department of Veterans Affairs . When considering a VA loan, many veterans start by looking up their entitlement online at the Veterans Information Portal. A common figure is $36,000, but borrowers should not assume that’s all the entitlement available.

If you do not have your full entitlement and want to use the VA loan to buy a house that costs more than $144,000, you may need to put make a down payment on the loan. The amount of the down payment will depend on your lenders policies, the cost of your home, the amount you are borrowing, your income, credit profile, debt-to-income ratio and other factors. If youve fallen in love with a house that tops the maximum in your area, dont despair.

All first-time users of VA home loan benefits start with enough entitlement for a mortgage of $417,000 (more in certain high-cost counties). Of course, borrowers must qualify with enough income and credit, among other requirements, for a loan of any amount regardless of how much entitlement they have. Having enough entitlement is one requirement in getting a VA home loan.

Comments

Post a Comment